BEOM-GYU JOENG [JADEN]

AI‑Native Quant Systems Architect & Agentic‑Automation Trading Engineer

AI‑driven Quant Engineer building institutional‑grade crypto trading systems with +44% verified performance, millisecond ML inference, and agentic automation.

My Expertise

Maximize Creativity and Intellectual Potential by Leveraging AI/Agents to Seek Alpha Through Revealing Patterns in Quantitative Trading.

Projects

A selection of my work, from full-stack trading systems to research prototypes.

Research & Ideas

A collection of my articles, explorations, and ideas on finance and technology.

January 24, 2026

Updated: Jan 26, 2026

December 10, 2025

Updated: Jan 8, 2026

December 5, 2025

Updated: Jan 9, 2026

November 15, 2025

Updated: Jan 25, 2026

October 15, 2025

Updated: Jan 24, 2026

October 12, 2025

Updated: Jan 24, 2026

October 11, 2025

Updated: Jan 24, 2026

October 10, 2025

Updated: Jan 24, 2026

October 1, 2025

Updated: Jan 8, 2026

September 20, 2025

Updated: Jan 25, 2026

September 1, 2025

Updated: Jan 26, 2026

August 31, 2025

August 31, 2025

July 6, 2025

Thoughts

Reflections on technology, finance, and the evolving landscape of algorithmic trading.

The Multiplicative Era: How Agentic AI Will Reshape Knowledge Work in 2026

Timeline

45 activities in 2026

Activity

Deployed external data alignment fix to production, achieved exact signal parity between Docker and K3S

New comprehensive guide (2,219 lines) for external data integration based on VVIX lessons learned

Updated LaTeX manual with T-1 Temporal Alignment pattern, code examples, and workflow diagrams

Knowledge Map

An interactive visualization of my skills, domains of expertise, and the tools I use. Hover over a node to see how my knowledge connects.

Work Experience

My professional journey in quantitative finance and technology.

Systematic Trader

Nov 2025 (3 weeks)

TradingView Trading Competition

- Achieved top 2% ranking out of 82,000 competitors in TradingView "The Leap" competition

- Generated 25.55% return ($100K to $125.5K) using systematic futures trading strategies

- Demonstrated exceptional risk management with minimal drawdown during volatile market conditions

- Traded CME futures (E-mini Nasdaq, Bitcoin, Ethereum) with high Sharpe ratio

Founder & Lead Quant Systems Architect

Jan 2025 - Present

Trade Matrix Labs

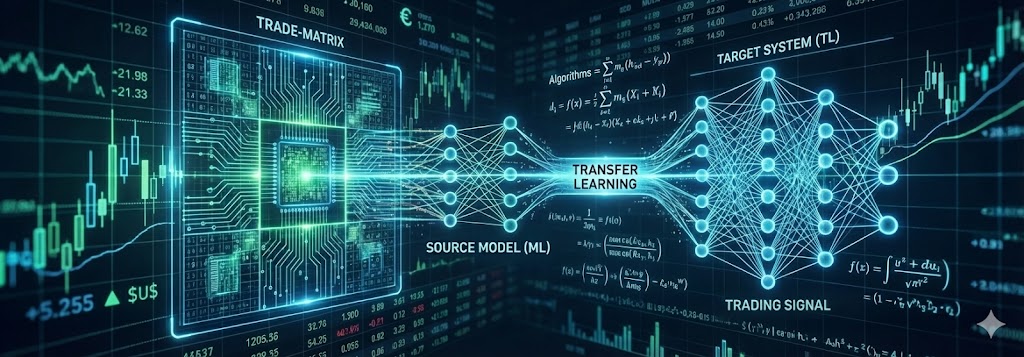

- Founded algorithmic trading startup developing institutional-grade cryptocurrency trading systems

- Designed and deployed a fully automated trading system as a solo engineer, including ML signal engine, RL position sizing, execution layer, and monitoring stack

- Built comprehensive research portfolio spanning market making, options pricing, and quantitative strategies

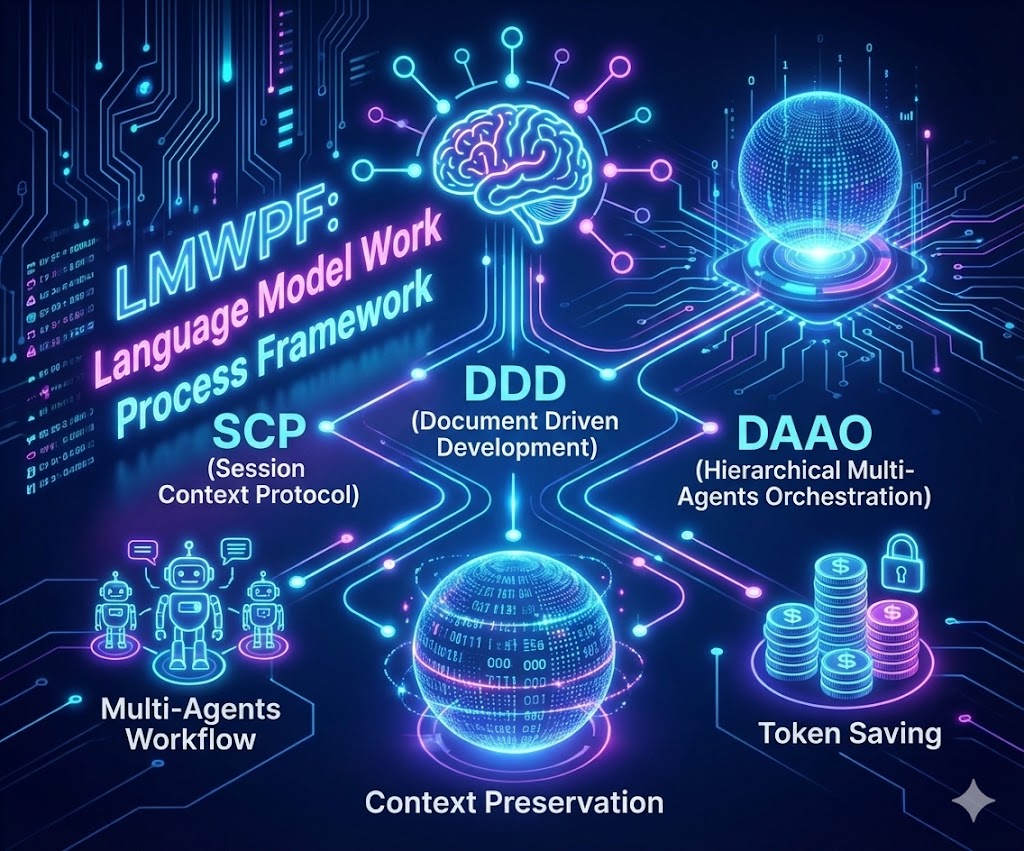

- Developed LMWPF framework for AI-assisted development with 42% efficiency improvement

RLHF Expert

Sep 2024 - Jan 2025 (5 months)

Outlier

- Contributed to Reinforcement Learning from Human Feedback (RLHF) for AI model training

- Specialized in mathematical reasoning and coding evaluation (Python, Java)

- Provided expert feedback to improve AI model accuracy in quantitative domains

- Applied rigorous mathematical analysis to validate model outputs

Co-Founder / Tech Lead

Aug 2018 - Sep 2023 (5 yrs 2 mos)

ZAMMA GmbH / Jin Entertainment

- Co-founded and led technology development for entertainment and events company

- Built and managed technical infrastructure for large-scale cultural events

- Applied business analytics to optimize operations and growth strategies

- Led KOREAN NIGHT | JIN ENTERTAINMENT event series production

Education

Academic foundation in finance, technology, and quantitative methods.

WorldQuant University

Jan 2025 - May 2026 (Current)

Master of Science - MS, Financial Engineering

Grade: 4.0/4.0

Technical University of Munich

Oct 2017 - Mar 2024

Bachelor's degree, Management and Technology

Specialized in Computer Engineering

Volunteering & Training Programs

Professional development through industry-leading training programs and initiatives.

Google Cloud Skills Boost

Trainee at Google

Mar - Sep 2024 (7 months)

Advanced training in Generative AI and Google Cloud Platform with focus on LLM operations and production deployment

Google Machine Learning Bootcamp 2023

Trainee at Google Developers

Aug - Dec 2023 (5 months)

Comprehensive bootcamp covering machine learning and deep learning fundamentals with hands-on projects

Get In Touch

Have a question or want to work together? Drop me a line.

Open to relocation to Dubai/Singapore for Quant/AI-Native System Architect/Crypto Trading Engineer roles.